Do you know how to register a company in Malaysia? How to incorporate a company in Malaysia when you are new investor? Do you know much much capital should minimum invest to register a new company in Malaysia? Do you know that you are allowed to disallowed to register a company in Malaysia as foreigner?

First step: Find a consultant/ company secretary who can assist to register your company in Malaysia. Talk to her/ him and / or email to know ins and out of company registration procedure a foreigner. First step is name reservation of your proposed company. Company Secretary shall provide a form to put signature by the directors, provided that minimum two directors need to register a private limited company in Malaysia. You can receive said form from sitting your country when deliver the form through courier. DHL is a faster courier can have first choice. Director can do registration process without physical visiting in Malaysia.

Second step: Company Secretary shall prepare memorandum and article of association with consultation of the directors. In that case some forms namely form 24, 44, 48 & 49 shall be filled up and put signature by the directors where company secretary shall put signature as authentication of the papers. As Company Act 1965 directors passport number and number of shares shall be written in form 24. Notice of registered office and working hours and days shall be mentioning in form 48 as section 120 (1). As section 141 (6) of Company Act 1965 form 49 is a particular of the directors where directors position with residence address shall be mentioning.

|

| How to register/ incorporate a company in Malaysia |

Its a sample copy of form 49

|

| how to register/ incorporate a company in Malaysia |

Its a sample copy of form 24

Third step: Once company incorporation procedure is done by the company secretary you can visit in Malaysia to open bank account.

Note: All foreign investors are requested to contact the bank before register a private limited company registration in Malaysia. It's a hassle of opening bank account in Malaysia.

- Minimum capital RM 2 to RM 500,000 is allowed by law as investment of pvt limited company.

- Why local residing director is required to register a new pvt limited company? If you have doubt or curious can contact us for clarification. Without local residing director company can be registered.

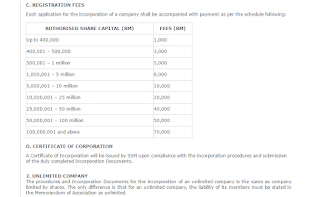

- What is the total fees including registration fees and professional consultancy fees? Consultancy fees vary from consultant to consultant upon business policy, experience and service quality.

|

| Authorized capital fees of pvt limited company in Malaysia |

Summary: To register a private limited company in Malaysia may need in total 3 to 7 days. Provided that, in case of additional licensing like import / export license may need additional time for 7 days. Further provided that investors shall know more detail information those goods are not allowed to import and/ or export in Malaysia. Manufacturing companies have to take permission from other ministry apart of SSM. Local banks do not allow to open corporate bank account but scenario on the other hand in foreign banks are flexible.

Business plan: Why investment in Malaysia and which business should choice to start up at beginning? We have noticed foreigners prefer to start food restaurant business in Malaysia as multi cultural people lives in Malaysia. To register a restaurant business there can be a pvt limited company from SSM and additional licensing are required from tourism department with proper measurement of restaurant space and maintain some other rules. Tourism business, IT business, consultancy, garments goods, electronics goods import business are attractive for Malaysia.